THE BLOG

A New Way Of Thinking About Traveling With Purpose

It is not how many places you visit, but how deep you go in each place you visit. It is not just traveling, it is...

A New Way Of Thinking About Traveling With Purpose

About 4 months ago, Taran and I came across each other. Our journeys intercepted in Thailand, at The Mindfulness Project, one of the most insightful and enriching adventures during my travels so far. The invite to write this guest post came at our last day at the project, which was coincidently the same, when I asked him to sign my MLA flag I carry along the way, where all of those I cross paths with leave their mark.

Now you may wonder, as everyone else does, what is a MLA? And that is the reason I am writing this post today, to introduce you a new concept of traveling with purpose.

But before I get there, let me give you a bit of background on how it started. For years I had been living on autopilot. Most of my decisions were more of a reflection of society, family and friends, rather than what I truly wanted for myself. Basically, I was mostly doing what I should, rather than what I wanted, not paying much attention to my intuition and inner voice. Decisions went from the area of study I chose, the universities I applied for, the master I finished, to the first and only company I worked for. And all those years I kept feeling something was not quite right, something was missing, there was no sense of realization, and there were only very few moments of true happiness, which kept being delayed to a distant future. Fortunately, almost 3 years ago I started questioning myself. I wanted more. I wanted to be happy at every moment of my life. And that, I believed, I would find by living fully by my purpose in the now. I listed a few options. Change jobs, change company, go back to study or… travel! I did apply for other jobs and other companies, I did check different PhD’s and also MBA’s. But none of them were appealing enough, neither had I thought they would bring me an answer to my quest. So, I was left with traveling. However, just traveling by itself was

also not attractive enough. So I slept on it. And one night the idea came. I am going to do a MLA, ie. a Master in Life Adventures.

The idea is simple: to travel the world whilst developing new skills and competencies and exploring and leveraging passions and talents. Whereas when studying I would have to fit the program, when doing a MLA the program would fit me, my desires, my needs, my questions and my objectives. The MLA would be fully owned by me and, therefore completely tailored to myself. An amazing opportunity to get inspired, to learn and develop and to meet people all over the world. And a little, or actually big hand in finding my purpose.

And, because of the stigma that still exists about traveling for long periods of time, especially in my home country, I wanted to show the world how beneficial, how enriching and how important traveling with purpose can be. That is why my dream is to transform the MLA concept into a certification, available to all. A certification that comprises of quality and that gives confidence to people wanting to travel with purpose, empowering them to fly and to flourish. This idea is work in progress at the moment and, for now, I am trying to prove the concept by being the first to officially do a MLA!

So, 8 months ago I finally quit my job. I didn't ask for a sabbatical, which I could have done. I just quit. I wanted to have time and space to explore. I wanted to go back to play, like when you are a child. I wanted the same flexibility, the same freedom. I wanted not to know what I was going to do next (the most frequently asked question I get). I wanted to allow any new opportunities that could come along.

I started by listing the adventures I always wanted to live but had never had the chance, the skills and competencies I wanted to develop and the countries I had always dreamed of visiting. And then, in January this year, I bought the tickets and in March I was taking off to India to begin my adventures with a 2 week yoga and meditation retreat at the Phool Chatti Ashram in Rishikesh. Breaking out of my auto-pilot and getting grounded were the objectives. I had never done yoga before, in fact, for years, I thought I hated it... I used to say out loud I was not interested in slow sports, as I would ignorantly characterize yoga. But I was willing to give it a chance with my MLA and it actually sounded like a good start. Far was I from realizing I would fall in love with the science behind yoga and make it a daily practice throughout the rest of my trip. Something I would have never realized without my MLA.

Admiring the Ganges River from Phool Chatti Ashram, Rishikesh, India

Getting certified in yoga and meditation from Phool Chatti Ashram, Rishikesh, India

Visiting The Beatles Ashram, Rishikesh, India

After one month in India, stopping at New Delhi, Rishikesh, Agra and Varanasi, I headed to Nepal to learn construction skills with All Hands Volunteers, helping to rebuild schools after the earthquake. Soon I realized heavy construction was not my thing. And the MLA is also that, trial and error, sense checking, answering questions. But I still loved the experience and getting to know the amazing people dedicating their time to such a great cause. Also because, for me, what matters the most are not the things you do, but whom you do them with.

Working day at All Hands Volunteers, Thulo Packar, Nepal

Resting day at All Hands Volunteers, Thulo Packar, Nepal

Exploring the local culture, Backtapur, Nepal

After 1 month in Nepal, stopping at Kathmandu, Thulo Packar, Backtapur, Patna and Pockara, I headed to Thailand to get immersed in permaculture and Buddhism at The Mindfulness Project. There, I would be developing different skills such as gardening, cooking, natural products making, teaching, yoga and meditation. And, again, getting to know beautiful people, from all over the world, with very different backgrounds and inspiring life stories to share.

Teaching English with The Mindfulness Project, Khon Kaen, Thailand

Saying farewell to The Mindfulness Project community, Khon Kaen, Thailand

After 3 weeks in Thailand, stopping at Bangkok, Hua Hin and Khon Khaen, I headed to Myanmar. This time, just for the purpose of visiting and getting inspired by the breathtaking landscapes and local culture. The MLA is also that, allowing the time and space to explore and get inspired by the beautiful places our earth has to offer.

Exploring hundreds of temples, Bagan, Myanmar

Getting inspired with painting like landscapes, Inle Lake, Myanmar

After 12 days in Myanmar, stopping at Mandalay, Bagan, Inle Lake and Yangoon, I headed to Bali, Indonesia. There, I used Work Away to find a hospitality volunteer job, where I could learn about the business, for which I always had an interest but never had the opportunity to experience. For 2 months I volunteered at an eco-guesthouse and yoga studio in Canggu, working directly with the general manager, supporting in strategy, marketing and human resources. I had the unique opportunity to dive into the business and to see most of my recommendations being implemented while I was still there. My remaining time in Bali was used for traveling around the island, exploring the delicious cafes, surfing and practicing yoga and meditation.

Shooting at the most photogenic beach in the world, Pandawa Beach, Bali, Indonesia

Going for a board meeting, Canggu, Bali, Indonesia

Fueling my working day, Cafe Organic, Canggu, Bali, Indonesia

Celebrating life through practice, The Practice, Canggu, Bali, Indonesia

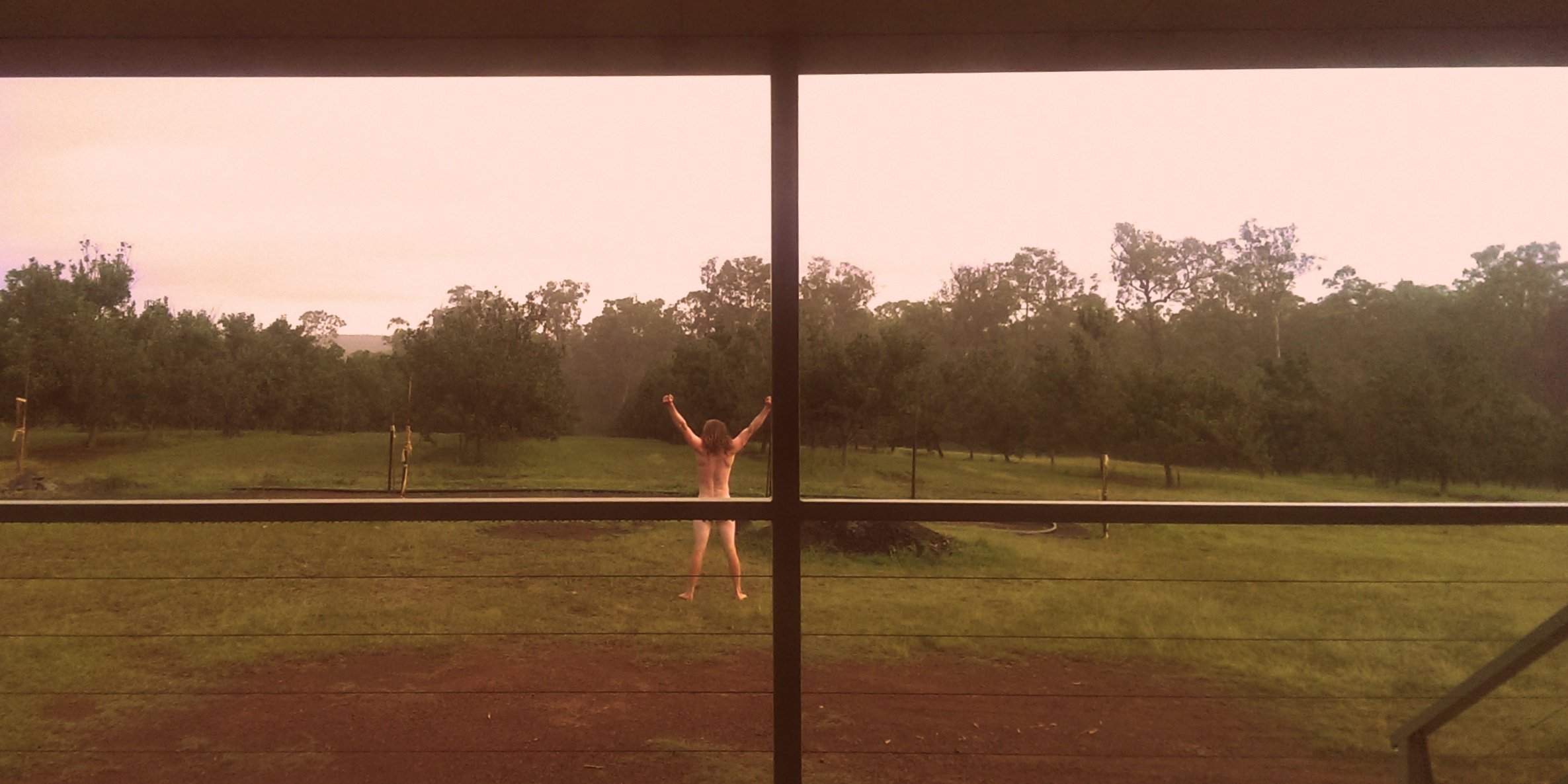

After living for 3 months in Bali, stopping at Canggu, Uluwatu and Ubud, I headed to Australia, where I am traveling at the moment along the New South Wales coast!

Celebrating Father’s Day with one of my host families, Sydney, Australia

Overlooking the Opera House, Sydney, Australia

Petting a kangaroo for the first time, Pambula, Australia

Overlooking one of the thousand beautiful beaches along the coast, Newcastle, Australia

Making it to the most easterly point of the Australian mainland, Byron Bay, Australia

"It is not how many places you visit, but how deep you go in each place you visit."

For the past 6 months, by developing different skills and competencies, by exploring and leveraging my passions and talents and by meeting so many extraordinary and inspiring people, I see myself closer to realize my purpose. And, because of that, I have shifted around my itinerary and, instead of literally going round the world as initially planned, I will return to the places which will support me the most in that mission. Because the MLA is not structure, it is flexibility. It is not rules, it is freedom. It is not a collection of adventures, it is a journey. It is not how many places you visit, but how deep you go in each place you visit. It is not just traveling, it is a transformational experience on the inside that reflects on the outside.

Thank you for reading and I would love to hear your thoughts and ideas about the MLA concept so, together, we can bring it to life.

You can follow my MLA journey at www.masterinlifeadventures.com

@catarinaholstein and @mla.haveyounoticed.

Thanks for reading!

Taran here, owner of Nomad'er How Far. I'm fond of psychedelic rock, photography & videography, anything to do with space and I'm also partial to the odd gaming session. Oh and I love to travel :P Get to know me here!

Be social and come follow me across the virtual world!

Latest Articles:

How I Went From Down And Out Graduate To Debt-Free Nomad In Less Than A Year

Recalling the path I was on 3.5 years ago, I shudder a little bit inside, I was embarking on...

How I Went From Down And Out Graduate To Debt-Free Nomad In Less Than A Year

Recalling how my life was 3.5 years ago, I was embarking on a new business venture, creating a self-employed life as a dog-walker and pet-sitter. This was the result of leaving my previous job, and bumming around unsure of what to do with myself for 3 months.

It didn't feel like it at the time, but the spring of 2013 was about to be major turning point, after 2011 and 2012 had been pretty painful.

At the end of 2012, I was in debt and pretending I wasn’t, continuing to spend mindlessly, buying new trendy stuff I didn't need, trying to make myself feel better. I was also kinda lonely, having been single for a good few months. I didn't have the best social life and my whole week was being swallowed up by my crappy job in a bank.

It was a bundle of laughs guys, truly.

My debt wasn't disgustingly huge and ridiculous, but I believe it was around the £3000 mark by the end of 2012. It was mostly credit card debt but also an overdraft from University.

It doesn't sound a lot, but it was for someone who was on a low income, whilst avidly pursuing everything... Literally, trying to consume every single thing.

I gave in to my sadness and disappointment at where I was in life, and continued to build my mini mountain of debt, partaking in window-shopping that turned into a shopping spree. Always having had a weakness for pretty things, I was going beyond that, consuming too much, too often. I would put things on my credit card willy-nilly and worry about it later.

The funny thing is, for the longest time as I entered my early 20's, I never had a credit card, nor even considered it. I spent what I had, and didn't spend what I didn't have.

A (very smart) part of me knew that credit was a bad idea for someone with my mentality. I loved buying clothes and other random things, and I had grown up accustomed to having what I wanted when I wanted it.

God, spoilt much?

Fortunate and well-cared for, definitely. Spoilt? maybe a tiny bit...

Anyway, I knew that as soon as a credit card came into my possession, my eyes would roll into pound signs and I would see it as a free money despite my better knowledge.

Why the hell did I get a credit card then?

I can’t remember the precise reason, but it was mid 2011, and I was going through some big life changes; moving in with a boyfriend and going into my final year of study. I do remember the cherry-popping card had an 18-month-interest-free period, the ultimate clever incentive of essentially free credit for almost 2 years!

That is a dangerously long grace period of being able to let debt mount up without accruing interest on top.

I think that's a key part of consumer debt psychology; people ask themselves, how long can I use credit and not really feel pain from it? How long can I pretend that I'm not living beyond my means whilst not trying to change them? Well, the credit card companies will always have a solution for you.

So the credit companies are the enemy?

Many credit cards are built on solidly decent perks, beneficial to those who know how to use them; people with self-control and probably a decent income, able to make each monthly payment whilst gaining air-miles or whatever. But that wasn’t me, and yet, because my income was of a certain level, it was as simple as filling in an online-form and BAM, a credit card with a £2000 credit limit now had my name on it.

That’s a lot of money to someone who was earning under £1000 a month and was new to this idea of adult financial freedom. For a while after my card arrived, I used it cautiously, paying for small amounts with it near the end of the month before pay-day. I promptly re-paid the full amount when it was due.

It wasn’t until a few months later, when I experienced a fairly traumatic and unexpected relationship break-up (from the boyfriend I had moved in with), that I suddenly looked at my credit card, and it looked at me, and we gave into a full-on passionate affair.

Takeaway meals when I was too depressed to cook, online shopping when I was too sad to leave my house, my credit card was my crutch.

I fell into debt not out of necessity, nor because I had bills to pay or some big holiday planned, I simply used credit for random daily spending, with the full intent to pay it back as and when. Underpinning this spending was a story I was telling myself, that I deserved this 'free' money. This credit card bought me the things I thought I wanted, or needed, in order to overcome my sadness.

In my hazy state I perceived junk-food and new clothing that I wouldn’t even remember in 3 years time, as my treats. I didn't buy self-help books, or invest money in trying new experiences, which sounds like a healthier approach, one I was simply incapable of in my down and out state. Maybe that's a stage you reach a little while after the initial impulse spending blow-outs following a break-up. But I didn't reach that point for months to come...

You’d have thought that the spending would have stopped a few weeks later, when I emerged from my sad girl cave and re-joined the functioning humans, but it was too late, I had already formed bad habits.

A few months later, life was mostly back on track. I graduated Uni with top marks, and I was on the cusp of entering real adult professional life. The first financial decision I made in my new grown-up life, truly was a nightmare dressed as a daydream (I just quoted a Taylor Swift song and it works); I got a brand new expensive car on finance.

I didn’t know anything about car finance until right before I took it on. I truly believe it was a win-win situation and I failed to account for how much of a commitment it was to take on.

I remember the precise moment, when walking through the supermarket car-park, when I fell in love with this little cream car. Sat there, all alluring and feminine, I knew, as soon as I laid my eyes on it, it had to be mine. It was a nippy little cream Fiat 500. So petite! So cute! So out of my price range.

Until someone said, ‘Did you know you can get the same car on finance?’

Interest piqued.

"What is this finance you speak of?"

Okay, so lemme get this straight, I hand over a little bit of money as a deposit, and I get a brand new shiny car. All I then have to do is pay £129 a month for the next 3 years, and then it's entirely mine? I can afford that so it must be a good idea!

Plus, I deserve it, I DESERVE a brand new car. I was still peddling that woe-is-me story to myself...

I thought this was an awesome turn of events. Car finance was helping me live out a dream of luxury. Little did I know it would be a short-lived buzz that would take me further away from the dreams faltering at my core.

I still feel guilt at the way I fell in love with that car far deeper than I ever did for my starter car, a little blue Vauxhall Corsa. I feel actual sadness that I gave that silly tin can away. But at the time, it was a fun change and it was just another part of my effort to feel better about myself.

The steering wheel on my pristine new baby felt so smooth and agile, and the car was so clean, and just, beautiful. I felt accomplished, like I had stepped up a rung on some invisible ladder of life success. I had a nice, smart card, nd I believed it helped me appear, to the outside, that I was winning at life.

But the reality was more like this:

I was working full-time in the same job I’d had since I was 16, a small supermarket where I jangled my keys as a supervisor and general checkout operator. This little weekend job had stayed with me throughout 3 years of university, and then turned into my main gig.

It wasn’t inspiring or fulfilling, at all, it was convenient, and familiar. I was trying to move into something better, namely, something that earned me more money. Whether the job truly suited me and my core values, was a secondary thought, a bonus in fact.

I wrongly sought out something that would bring me more money to buy more stuff to be more happy. But had my consumption made me happy up to that point?

I ask myself this question a lot...

Was I unhappy because I spent my money impulsively to fill a lonely void, and thus wasn’t planning for a fulfilling future based on real experiences. Or, was I just suffering from a mental illness and using the incorrect tools to fix it.

I'm certain that I was unhappy in myself and perceived buying things to add to my image as a way to attract the right kind of people who could fill the space in my sad ickle heart.

I sound as if I'm making light of my situation, but I was, in fact, headed for clinical depression. I got there eventually and I fell into a dark pit that I tried to escape every time I went to a clothes shop. I was desperately hating my job in a bank, where I had to partake in awful sales stuff as well as be responsible for people's real actual money. To this day I hate sales-y people or anyone who targets me with bull-shit for their own monetary gain.

So that job didn’t work with me, at all. Yes, I had money, I was able to shop more, and show off my nice car to my colleagues, but I wasn't actually a happy or sane individual.

I had some traditional markers of success and yet, I was also deeply disappointed. In the pit of my being, I was asking, is this it? Is this my life, from now on and forever?

Like what you're reading?

Join the email gang for bonus content and conversation.

How Did I Change Things For The Better?

Well, I overcame that difficult time through a variety of avenues. Prescribed pills were involved (for a short while), falling in love played a large part, and of course, time was a big healer. I moved through my issues gradually, grew my little business as a dog-walker, and I was finally engaging with the world in a healthy manner. I eventually began making exciting plans.

My exciting plans had no room for debt or financial over-stretching; they were geared to financial freedom.

I got rid of my car out of necessity. My expensive gift to myself was now a chain around my neck on my new low income, and it didn’t suit my business as a dog-walker. So I went through the rigmarole of advertising it, temporarily clearing the finance with a family loan, then repaying that back when my car sold. Yep, a total effort.

I rid myself of that 129 a month and then focused all my energy on debt repayment. I kept a diary of all the amounts I owed and to whom. I decided to clear the smallest debt first, because it would be a surmountable goal that would boost my morale. There was no doubt in my mind that I would clear all the debts, because I had a goal for doing so, it just made sense to me to start small.

My exciting plans were that I wanted to travel Australia with Taran. I did the research and got sucked in by the absolute beauty of this very far-away land, and I just knew I had to get there.

I didn’t want to just go away for a year, I wanted to travel for a long time. I decided that being out there in the world, exploring it almost without purpose, would be the optimal way to reconnect with all the best parts of living.

Driven by this goal, I threw literally as much as I possibly could at my debts each week.

I got paid sporadically due to being self-employed so if my money came in drib's and drab's, I threw it at my debt in drib's and drab's. If I had an unexpected booking that led to a lot of extra money, I didn’t hold onto that money for a second, I sent it on a one way debt-clearing journey.

That is certainly one of the difficult parts of paying off debt and an obvious reason for why people delay repayments. We see our pay-check as having a better or more exciting purpose in the present, instead of going into a black-hole that brings nothing. But it does bring something eventually. It brings back financial clarity, control and an ability to plan for the future.

I think even if I hadn’t wanted to save up for travelling, I would have put my new positive financial situation to a good purpose, and I would have developed smaller, every-day goals, centred around family, relationships, and experiences.

When my life lacked greatly in these areas, when my time, money and energy was going purely to consumerism, I was miserable.

Then again, it goes back to my question around shopping addiction as the cause or effect of my depression. It was mental health versus financial health, and neither side was fighting strong.

That's why the true approach to tackling debt goes beyond the common tropes of spending less, working more and going without. Those things help clear the debt, but they don't deal with what lies underneath. They don't prevent debt occurring later on, or alter your mentality away from consumption as self-prescribed therapy.

It’s a truth, not merely a pleasant idea, that we should build our finances around sustainable, long-term and deep fulfilment.

My motivation wasn’t to explore in order to ‘get it out my system’ or escape the trappings of real life, it was about creating a whole new path, based on experiencing far-flung places, doing crazy things beyond what I believed I could and ultimately, discovering myself. I believed that my long-term fulfilment could be built on solid foundations formed from these experiences.

The Key Is To Not Go It Alone

Many of my peers and fellow graduate millennials often say that they wish they had the money to travel. In truth, some definitely do have the money, they just choose to allocate it to other things, and that's their business.

Many people however are bound by extortionate outgoings and financial commitments, as I was, and are navigating the same personal battle I did. I came through it thanks to the support of friends, family, and of course, Taran. That's why I recommend surrounding yourself with people or positive influences that will encourage you on your journey to being debt-free.

If those around you bolster the behaviours that are the most detrimental to you, then it's time to get real, have some honest conversations, and be clear in your motivations for changing things.

If you lack a supportive circle of like-minded individuals, I get that it makes debt repayment hard. But plenty of people out there are super into these lifestyle ideas, of thrift, frugality, and minimalism. In fact I wrote a whole book on that last topic. And the idea of being 100% debt-free, as in owing zero to anyone and clearing a mortgage earlier, is a major movement.

There is a tribe out there with open arms awaiting you, without a doubt.

Some of my favourite finance-oriented and majorly inspiring people:

My journey from down and out, to who I am now, has been a relatively long one, but I've finally got to where I want to be.

A year into travelling, and 2 since I became debt-free, I’ve worked as a farmer, a cook/receptionist/housekeeper and a cleaner. These are definitely not dream jobs, but they are short-term ventures targeted at a specific goal. But that's just the boring necessary stuff.

I've also camped on a completely deserted paradise island, with ocean so clear my eyes couldn't believe it. I've jumped out of a plane, held a snake, stroked a kangaroo and rescued a koala (not all at the same time).

I opened myself up to the unpredictable nature of life, embracing what scares me.

The result is that I have lived, and it's been an awfully big adventure.

What did my debt experience teach me?

I learned in my early 20's, that debt, whilst sometimes unavoidable, can often be prevented if we are open and honest with ourselves and those around us. I lost control of my life because I was suffering alone, smothering my inner truth, and favouring my unhealthy spending habits over the challenge of building new ones.

But I don't do that any-more, and I'd like to think that others can escape that spiral too. We can spend our money mindfully today, in the pursuit of something amazing, someday.

And that someday needn’t be so far away that we can't picture it and keep focus.

We can take stepping stones, steadily moving to the other side, to a place where we can start over again, begin listening to our core values, and live by them, forming new habits that will fulfil our truthful needs.

What motivates you to become unencumbered by debt?

Thanks for reading!

Hannah here, one half of NomaderHowFar. I love reading, the beach, proper fish and chips, and a good cup of tea. But I mostly like to chat about minimalism, simplifying your life, the beauty of travel and sometimes I get a bit deep. Get to know us here!

Be social and come follow us across the virtual world!

Is it Worth Quitting your Job To Travel?

Does hitch-hiking along a dusty road, backpack on and thumb out sound better than a safe drive to the shops and back?

Is it Worth Quitting your Job To Travel?

Some people spend years climbing a career-ladder, or studying, all in the pursuit of their dream job. Many of them invest a lot of time and energy into this pursuit, some foregoing other things, like families, relationships, and of course, travel. For many people the sacrifice can seem worth it.

This isn't the case for us however. Having both quit our jobs to travel the world, starting with exploring Australia for 2 years, we didn't feel like walking out on our jobs was the hardest thing to do, unlike others our age might feel.

We were not in careers that earned us much money; my job was working a few days a week making just enough money to pay rent, feed myself and save a little bit on the side.. I knew that I wanted change soon.

Hannah was in a different position, she ran her own dog walking business and loved it! But she too didn't like the thought of doing it for the rest of her life..

So leaving our jobs wasn't a big deal for us, but for many other people our age it is a different story. Once you get to your mid 20's most of us will have moved out of our parents homes and will be either paying rent or locked into a mortgage which makes things way harder.

That being said almost half a year in and we have managed to keep our expenses way down, which has meant we have had more time to explore without having to top up our funds with part time jobs. Our relatively small savings have been stretched to the limit!

We still cringe when other backpackers tell us how many thousands of dollars they have spent over the last few months on alcohol and partying..

That's not to say we don't like a drink, we just do it differently; a beer/cider from the bottle shop on the beach has always been a better option to us than a drink in a bar.

Like what you're reading?

Then be an awesome person and sign up to our weekly update!

Plan!

★ When it comes to saving, you don't have to follow the crowd and take out a loan to travel the world.. In fact you don't really need that much at all! Depending on your style of travel of course.. We have a taken every opportunity to save money; we hitch-hike, camp, couch-surf, drink tap water and eat cheaply! If you follow these tips and use your own common sense you should be able to make about 5000 AU Dollars last 6+ months easily!

Mike from NZ couch surfing with us!

★ Setting a date will cement things in your head and will really help you ramp up the saving and will also help you mentally plan for it. You're about to make a great decision that will change you forever.

★ Start couch-surfing via your current home (if possible). We started having people stay with us before we set off on the road. Its a great way to meet amazing people currently travelling and will also get you excited to get on the road!

Change!

Does hitch-hiking along a dusty road, backpack on and thumb out sound better than a safe drive to the shops and back, does setting up camp on a beach under the stars or meeting amazing people from different cultures sound like your kind of thing?

If you truly want something in life, you will work your hardest to get it.. And if travelling the world is something you long to do, then there is no doubt that whatever your situation, you will eventually reach your goal and live out your dreams!

Our 2 years in Australia started in March 2015 and we have had an absolute blast taking in everything that it has to offer, but there is still so much to see! And that, my friend, is the beauty of it all, there is so much to see in this world and many adventures to come, which will surely be filled with exploration, tales of peril and awe-inspiring views that will continue to take our breathe away!

We feel like we made one of the best decisions of our life.

Thanks for reading!

Taran here, one half of NomaderHowFar. I'm fond of psychedelic rock, photography & videography, forcing Hannah to do crazy things, and I'm also partial to the odd gaming session. Oh and I love to travel :P Get to know us here!

Want More?!

4 Steps To A Minimalist Life: Nomadifying Your World

Life is somewhat defined by accumulation; gathering memories of special experiences, meeting people and forming loving relationships. We accumulate these connections when we are living our lives to the fullest and they are part of what constitutes 'Happiness', in my opinion.

4 Steps to A Minimalist Life: Nomadifying Your World

*This is one of our first post's about Minimalism from way back in 2014. We have come a lot further down the road of simplifying, and we did indeed follow our nomadic dreams, and currently live in Australia. For more recent and expansive reading on this topic, check out the minimalism section*

Life is somewhat defined by accumulation; gathering memories of special experiences, meeting people and forming loving relationships.

We accumulate these connections when we are living our lives to the fullest and they are part of what constitutes happiness and fulfillment for most people.

The flip-side to this, is the accumulation of things, material goods and random accoutrements; many people also associate being wealthy and acquiring 'things', with happiness.

I disagree on that point, and so do followers of the minimalist movement. Many steadfast simplifiers come from big money backgrounds, who traded in the corporate lifestyle when they realized it wasn't the key to deep and lasting fulfillment.

An article written by Rebecca J. Rosen of The Atlantic interviews people who changed their lives radically and improved their all-round happiness and stress levels tenfold...

How did they do this? By adopting a minimalist style of living.

I had been thinking about making a blog post about de-cluttering your surroundings and your life, for quite a while, and happened upon this article which perfectly highlights the ideas behind my own changing relationship with consumerism.

The interviewees are consciously selective about what they do acquire, and seek to add only things with meaning and true usefulness.

That's only further spurred on my desire to Nomad-Ify my own life.

Nomad-ify?

Apart from seemingly inventing a word, I really mean, simplifying your surroundings and belongings, so that you are truly prepared for a nomadic travel lifestyle.

And if you aren't planning to travel any time soon, you can still follow these ideas, and achieve the same positive effects for your own life.

Wouldn't it be nice if every time you moved home, it wasn't such a stressful process, because you simply had less stuff to move?

How pleasant might it feel if your cleaning routine took half the time and you suddenly created a more productive day with time to spare?

Step 1: Time To Off-Load

- Pick a drawer. Pick a cupboard. Pick a whole room in your house if you like. Just begin somewhere. Choose the space which is stressing you out the most, or, select the smallest space.

- Question your possessions. For example, go to the kitchen cupboard and question, why do I have 40 mugs, when I only have one mouth? Now go up to the bathroom. Why do I have 8 varieties of shower gel on the go, when all I do is wash it down the drain?

- Before you try and fix everywhere in your home, really focus on the space you either spend the most time, or the place you go to feel relaxed. For me, that is the bedroom... I love having a minimalist and tidy feel to mine, it creates a really relaxed feeling in there. I have cultivated that by spending months slowly getting rid of stuff. Go over to the wardrobe or drawers....it's time to tackle the clothes. Get some plastic bins or baskets, and label them Charity, Donation and Bin. Charity for the charity shop, donation for those huge bins they have in supermarket car parks where you can donate clothes that are not quite good enough for resale, and then the bin, well, that's for the stained pair of comfy jogging bottoms you can't bear to part with. Of course the clothes you want to keep, put to one side. Also, if you wish to sell some things, create a separate pile for this. Bear in mind that we often set aside clothing we believe will make us some money back and we just never set aside time to actually list them for sale!

We're not just discarding stuff without thought here, we are reassessing it's value in OUR lives and whether these items are useful to US. When the answer is no, then this stuff becomes useful to others, or is just junk, and it's time to say goodbye to it.

RULES: HAVE I USED THIS ITEM WITHIN THE LAST 6 MONTHS? WOULD I BUY THIS IF I SAW IT IN A SHOP TODAY?

If you answer No, then put it in the chosen pile.

Pheww! you are already nearer to the minimalist life.

Step 2: A Shopping Detox

Is it a big hobby of yours to peruse local supermarkets or head into town to the shopping centre, just to mull around, even though you always end up buying SOMETHING. Well, you are now on a shopping ban. Don't worry, you can still buy food, we aren't talking about de-cluttering our bodies here (food is my one spending vice, it keeps me sane).

- If you are shopping to quell boredom, find escapism or seek that momentary buzz associated with acquiring something new and shiny, could you be using that time and money more healthily?

- Do you struggle to pay bills or are you unable to repay your debts because of what you spending on random things?

- Confront yourself. Are you guilty of needless and impulse spending? Are you one of those people who comes home with several shopping bags a few times a month? STOPPPP ITTT. For a while at least. It's more of a bad habit, not a fun hobby; you need to see it that way in order to realize you can stop doing it so much.

RULES: DO I REALLY NEED THIS DRESS? IS IT OF SUPERIOR QUALITY TO ANYTHING I ALREADY OWN? DO I NEED THIS PAIR OF HEELS WHEN I LIVE IN FLATS? DO I NEED ANOTHER THROW CUSHION WHEN ALL I DO IS LITERALLY THROW THEM OFF THE BED EACH NIGHT?

Be honest with yourself, nobody needs eight cushions.

Step 3: Make Money, Make Room

So you've tidied up, and thrown lots away. Now it's time to tackle the stuff you could make some money out of.

- List items of quality on Ebay or gumtree (craiglist if you are American) and set yourself a target of how much extra money you want to make selling your things. If you a figure in mind you will feel more motivated to follow through on listing, advertising and selling.

- Go to a car boot sale (or have a garage sale), and let your things find a new home. Just because you no longer need this item, doesn't render it useless or unappealing to someone else.

- Consider if some of your things could be repurposed, like old furniture or decorative items, that you could then re-sell at a decent value.

RULE: WILL I BE USING THIS AGAIN ANY TIME SOON? WILL I BE ABLE TO REPURCHASE IT IF I EVER DO NEED IT AGAIN? DO I SOURCE ANY DAILY ENJOYMENT OUT OF THIS OBJECT?

Step 4: Envision A Simpler Life

When I clean or tidy, or throw stuff away, I feel physically and mentally lighter.

Whether it's all in my head or whether its my energy responding to something different in my surroundings, it brings a sense of calm and peace. I feel so much more prepared for my nomadic dreams knowing my clutter footprint is reduced.

The idea of travelling becomes even more exciting to me and the thought of leaving behind what belongings remain, incredibly easy.

As I witness myself saving money and not buying more random stuff, I imagine enjoying a day on the beach in Australia, where my last concern will be for the stuff I threw away; it will just be Taran, me, a towel and the sea.

What do you see when you imagine a simpler life?

What steps do you need to take to reach that? Maybe begin with the above 3.

Possibly it's about changing your attitude towards consumerism.

Maybe you need to take up some hobbies which don't rely on accumulating stuff or spending much money. If we can develop passions that are independent of our financial state, that can withstand times of difficulty, we will learn to be happy with less; less stress, less push for money and less financial commitment, but, more joy.

It's not just about throwing things away, it's a re-imagining of your relationship to material things; your happiness can come from so much more than what's in a shop window. When I felt lost and passionless, I also had massive debts and a huge shopping addiction. I was miserable and misguided in how I used my money. When I fully embraced the multiple benefits of a minimalist life, I did indeed find my dreams, follow them and start afresh.

Your bank balance does not define how full your life can be. It's how you use your money, your time and your energy that will lead to long-lasting fulfilment.

So take control, de-clutter, and Nomad-ify yourself.

Why? Because it feels really, really, good.

Hey, before you go...

In 2016 I released my Book: Minimalism: Cleanse Your Life, Become A Calmer Person

If you're into minimalism or reducing stress, its really worth a read!

Thanks for reading!

Hannah and Taran here. We hail from Southern England, where we met online and are now realizing our mutual passion for travel here at NomaderHowFar. We discuss Nomadic Living, Simplifying your Life and Long-term Travel, to empower, motivate and inspire our readers. Get to know us here!

WANT MORE?

The First Step to Nomadic Life

If your lifestyle choices and behaviour are incongruous with your nomadic aspirations, then something has to change, right away!

The First Step to Nomadic Life

UPDATED 2016: This was the first post on Nomad'er How Far, written over 2 years ago when travel remained a pipe dream for us. Well, the dream did come true and you can read our more recent adventures here. But first, let's start at the beginning...

So, you fancy a little trip around the world?

Not so little, a big one, maybe a year?...

Now if you are anything like me and like to dream of when you will win the lottery (despite not even playing it), you have grand plans and an even grander hole in your bank balance.

I have been it all; part-time checkout girl, a teenager spending all my money on cheap clothes; scruffy student, spending all my money on cheap clothes..., customer advisor in a bank, spending all my money on cheap clothes.

Ah, ok, so something of a trend that caught on at a young age and stayed put well into my 20's.

However, thing's are a little different now. Now, a 23-year-old self-employed grown-up, a business owner, running a small pet-care company in my local area, I now spend all my money on dog treats and petrol...

Times have-a changed.

Yes my circumstances have become a little more stretched, and disposable income is not a term i am now familiar with, but that hasn't stopped me dreaming BIG.

I want to travel and work abroad, and do it for as long as I possibly can.

Wherever you currently are in your life, your path remains undecided, malleable and somewhat in your control.

If your lifestyle choices and behaviour are incongruous with your nomadic aspirations, then something has to change, right away!

Prioritize Your Debts.

Do you have debts hanging over your shoulders?

Do you owe something on your credit card, or a lingering student overdraft you just pretend does not exist?

Maybe you have been putting off doing that balance transfer and are paying back almost nothing.

Maybe you keep choosing to buy more and more, piling on the debt! Well it is time to face the debt situation, head-on.

Make it your priority to clear these debts/ stop building them, because:

1. You cannot save effectively whilst trying to also clear debts.

2. You will find deep satisfaction in knowing that your hard-earned savings are purely growing to make your travel dreams come true, not line the credit card companies pockets.

3. You can't travel with debt! You want to be focusing on enjoying those savings on amazing day trips to the Great Barrier Reef, not fumbling around trying to make debt repayments. Plus income is totally changeable and unpredictable during working travel, so debt, well, that stuff will drag you down.

You can make sure you leave debt behind and here's how:

List Your Debts

Be honest, and write down each and every debt, be it between you and a creditor, or even small amounts owed to family or friends.

List them from smallest to largest. Note what you currently repay and work out how many months it would take to clear debts paying only this amount monthly.

The financial flexibility that can come with travel can't really ever be truly experienced if we embark on amazing adventures but don't square off certain financial burdens first.

Analyse Your Spending

Honestly review how you spend your money. I prefer to keep receipts and write down the amounts I spend and relate them a specific category, but if you don't do this then use your recent paper or online statement for reference.

Even just a quick scan on your transaction list on online banking may provide some shocking discoveries.

When you spend something, maybe a small amount for example, you weigh that up in low terms, and neglect to add it on to all the other things you have recently spent money on; you aren't thinking of the bigger picture each time you spend.

Re-direct Your Income

It's time to realize that you have to redirect some of your income flow to clearing debts or nothing will change. You will continue on the same path and not create a new destination and a healthy set of habits designed to get you there.

You need to reassess how much you need those things or activities which you view as essential treats or fun. You need to imagine yourself experiencing worse financial circumstances, the kind where you are forced to find other cheaper or creative ways to fill your free time, because there doesn't have to be a correlation between how fulfilled you are and how much money you are making at a given time.

For example, when I made a decent income at a bank I was also suffering from depression, and when I was the poorest I had ever been, I was also finding love and inner peace.

Crazy how we can scramble our way to happiness despite our financial situation.

So I suggest you wholeheartedly use this mindset to channel your energy toward using your money differently; it should be seen as a tool to get out of debt and into your chosen dream, not a short-cut to momentary gratification.

Start Small

It makes sense to focus on clearing the smaller debts purely so you reach a positive stage in your overall goals sooner. Plus, when you remove the smaller obstacles you gain the momentum needed to muscle through the bigger debts. Once the clutter of the small numbers are removed you can focus larger chunks of money toward one large debt.

Celebrate each and every debt that's cleared, and recognize each success as proof that with time, effort and energy, you can create a better life, whatever that might look like.

So first things first on this journey to nomadic life, start being wiser and more thrifty with your pennies, and throw them at your debts. Then the fun of saving and scrimping can begin...

Thanks for reading!

Hannah and Taran here. We hail from Southern England, where we met online and are now realizing our mutual passion for travel here at NomaderHowFar. We discuss Nomadic Living, Simplifying your Life and Long-term Travel, to empower, motivate and inspire our readers. Get to know us here!